In my last distilling the major themes of the Energy Transition, one thing that is staring us right in the face is that, despite the exponential scaling of wind and (in particular) solar, increases in renewable generation still isn’t outpacing the world’s demand for electricity, with emissions continuing to creep higher. We need more. More, more, more. The challenges posed by increasing penetration of variable generation are real. And, whilst technology is developing rapidly to address those challenges (batteries, load-shifting, grid management) it is clear that we are going to need more dispatchable, low-carbon generation (“clean firm”) to complement wind, solar and batteries. That basically means hydro, combustion + capture (e.g. NetPower), nuclear, or geothermal. I wanted to do dedicated posts at least on the latter two to get everyone reorientated on where we stand, starting with geothermal. In this piece I’m really going to focus on the main companies in the space and observable progress. There are many other companies besides those I mention below, but most are very early stage and are not yet relevant for an overall orientation on the space. I am also explicitly not going to drilling developments for ground source heat pumps (companies like Bedrock, Dandelion, Bororobotics) to keep the focus on power.

For more background on geothermal and some of the opportunities and challenges, I covered the DoE’s Geothermal Pathway to Liftoff report in a previous post. Also, the IEA in collaboration with Project Innerspace recently released their first geothermal report. That report is worth flicking through but the key takeaways are:

The potential is vast - functionally limitless

Cost reductions are required but there is a clear path to make competitive with fossil generation (the report suggests a further 80% cost reductions, but that looks high vs the progress already made by Fervo, as discussed below)

About 80% of the investment requirements for enhanced geothermal represent direct transfer from oil and gas, so there is a large skilled workforce in place

Additionally, I would be remiss not to share the geothermal anthem - Our love is geothermal. Dripping sweat getting next to you, baby…

Fervo

I concluded my last post with what I thought was one of the most hopeful charts of the year:

This shows the dramatic learning curves that Fervo has achieved in drilling at its first project in Utah. Fervo has really become the poster-child for geothermal. Although they are not the only company out there, they are the breakout leader and have carved out the opportunity space for other companies, so I’ll dwell on their progress a bit more here. As luck would have it, Volts just dropped an excellent podcast with Tim Latimer, Fervo’s CEO, last week, which included lots of juicy specific updates and I would encourage readers to check out in full.

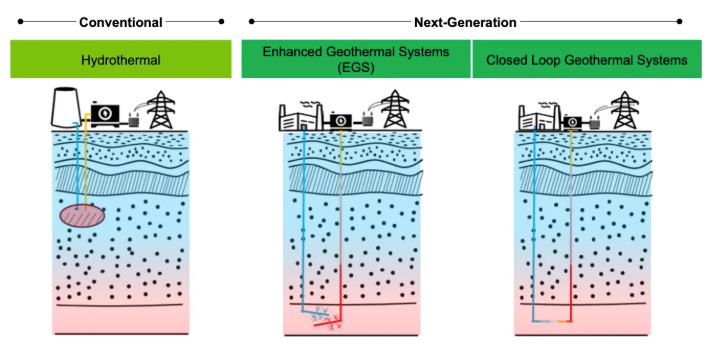

By way of brief introduction, Fervo is an Enhanced Geothermal System (EGS) developer. EGS differs from traditional geothermal in that it doesn’t require the specific geological conditions of permeable aquifers. Instead they are porting fracking know-how from the oil and gas industry to create their own system of fissures subsurface through which water permeates and heats. Demonstrated here compared with conventional geothermal and closed-loop:

Some highlights and key takeaways on Fervo:

Core innovation is using horizontal drilling technology from the oil and gas industry, which allows much more heat resource to be accessed per well

Fervo’s initial offtake partner was Google.

Last year, the company raised $380mm in equity across two rounds, the first led by strategic Devon Energy (O&G company). They also secured a $120mm line of credit from Mercuria and $100mm loan from USDA.

Pilot plant in Nevada - at the sight of an existing geothermal plant, they were able to demonstrate the tech, with an output of >3MWe for a two-well system with Google as the offtake partner.

Currently working on their first commercial system in Utah at Cape Station - a 400MW power plant, with permitting to expand to 2GW on that site. The first 100MW is due to be producing power next year.

Progress on drilling costs: Fervo has made wild improvements in drilling times (and therefore costs) with a series of innovations. This is a prime example of the benefits of learning-by-doing and why a focus on deployment is critical for new technologies.

There was a challenge to adapt traditional oil and gas drilling gear for geothermal because it requires drilling in hard rock, which isn’t an issue for O&G. Fervo had to learn how to use polycrystalline drill bit (picture below because it looks cool) in hard rock.

Because of the size of the field operations, time=money.

The first well took 75 days to drill 3,000 ft horizontally and they broke 13 drill bits in the process = $13mm

The tenth well took 13 days to drill 5,000 ft horizontally and broke only 1 drill bit = <$4mm

Drilling farther horizontally (moving from 3,000 ft to 5,000 ft) along with other tweaks is making wells more productive. Initial wells were 3MWe, now up to 10MWe.

Fervo has plans to extend to 7,500 ft horizontal wells later this year and then 10,000 - 15,000 ft over the next 2-3 years.

Deeper wells are also accessing greater heat resource - first wells at 8,000 ft were at 350 degrees Fahrenheit, now at 9,000 ft / 400F, next year 11,000 ft and 450F (~230C). Because heat transfer is more efficient at higher temperatures, you get 30% more power from 450F compared to 400F.

Drilling costs now getting to sub-$2,000 / kW, which means that it is becoming the cheaper part of the operation, with innovation focus now switching to the power plant.

Power plant and modularity:

The initial 100MW at Cape Station will be comprised of three 33MW power plants. The next phase - which will represent steady state - will use 50MW turbines on each drill pad (with 5 production wells per pad).

Settling on a modest size for the power plant strikes the right balance between efficiency and modularity, enabling a steeper learning curve.

Fervo is using organic rankine cycle (ORC) turbines rather than steam. ORC turbines have greater efficiency with low grade heat and also sidesteps issues around contaminants in the geothermal brine or escaped CO2 etc, because the heat is transferred indirectly.

There are only 4,000 MW of ORC turbines deployed globally, so the technology, even though it is old, isn’t very far down the cost curve. Phase 1 of the Cape Station plant by itself will represent a 10% increase in global deployment. There is still lots of room for improvement.

Total costs for current projects - drilling + powerplant - is around $6,000 / kW. Fervo thinks that can drop to less than $3,000 / kW over the next 2-3 projects and before 2030.

Geothermal as a flexible resource: Fervo have demonstrated that their wells can be used flexibly to compliment solar. They can run the injection well during the day and allow the system to build up sufficient pressure so that it can self-flow and produce when the system is switched on in the evening. For a 3MWe plant, the pumping represents a 500-700kW parasitic load, so the system can be a net load during the day and offtake solar generation and then have higher net output at night. (Findings of this work published in Nature here.)

Political support

Geothermal, alongside nuclear, is one of the rare technologies that has support across both sides of the aisle in the US (as evidenced by a bipartisan law focussed on geothermal that was part of the unfortunately failed permitting reform last year).

The new Energy Secretary, Chris Wright, was a Fervo investor through his firm Liberty Energy and has clearly and publicly expressed his enthusiasm for its potential.

Last year the Bureau of Land Management granted geothermal a categorical exclusion, which means that it deemed safe and doesn’t need to go through certain environmental permitting when on public lands.

Sage Geosystems

Sage is another next-gen geothermal company. Their approach is slightly different in that they are using a single well as both injection and production, utilising the pressure in the rock to flow the heat back to the surface, what the company calls Geopressured Geothermal System (GGS), but is a similar principle to EGS in that they are using fracking tech to create fissures in a rock space. They have applications both for storage and for power production. Sage completed a demonstration of their tech in Texas in 2022 and last year announced a partnership with Meta to deliver 150MW, starting in 2027.

Eavor - closed loop

In contrast to Fervo and Sage, Eavor is pursuing a closed-loop system approach. So rather than creating fissures through fracking and pushing fluid through a whole area, they used a closed loop (as the name suggests) of bore holes to run the fluid through. This version does away with any concerns around seismic impact of fracking, but it massively reduces the surface area available for heat transfer. As a result, it is necessary to drill a lot more for the same resource. For their 8MW project in Germany, the company is drilling 220 miles! The upshot is that the DoE’s stretch cost target for closed loop is double that of EGS and we think this puts some inherent caps on the scalability of closed loop technology. Having said this, there are some innovations to make the most out of the surface area available. XGS Energy has a thermally conductive material they say improves heat transfer by 30-50%.

Super deep / hot drilling

EGS developers are breaking out beyond the conditions that are required by conventional geothermal, but are still accessing low-ish grade heat around 200 degrees C, prospectively moving up to 230C soon (using numbers given by Fervo above). Given the exponential relationship between energy transfer and heat, there is a significant prize for going deeper and hotter and then, eventually, to get to supercritical steam (>400C). An alluring vision is to repower coal power plants (steam temperature ~550C) with super hot geothermal. The challenge is that the current drilling gear can’t handle those temperatures. Quaise Energy and GA Drilling are two companies working on alternative drilling technology, both essentially vapourising rock rather than grinding it, so there doesn’t need to be contact between a drill bit and rock. (GA Drilling also has a technology that can be used in conjunction with traditional drilling, the Anchorbit, which is faster to market.) Both companies also have partnerships with incumbent drilling firm Nabors, as indeed do Sage and another high-temperature drilling tech firm, Haphae, who are building sensors and electronics that can withstand higher heat. Based on public announcements, both Quaise and GA seem to be making headway although it does not appear that commercial deployment of the vapourisation tech is imminent. They face the major question of all breakthrough tech - are they going to be able to commercialise fast enough to outpace the learning-by-doing improvements in incumbent technologies? That remains to be seen, but the vision of accessing super hot geothermal anywhere on earth is a compelling one! (For more on that vision, you can see CATF’s introduction to super hot rock geothermal.) The last company to flag here is Canopus Drilling of Holland, who has a Directional Steel Shot Drilling tech, that uses a high-powered stream of - you guessed it - steel shot to pulverise rock.

Developers

Critical to the scaling of any infrastructure-like technology is an ecosystem of developers to create projects. (Imagine if solar manufacturers were responsible for developing all the solar farms!) Fresh off the press, Ignis Energy just announced a $12.5mm series A, led by alfa8 with participation from, again, Nabors. The group has projects under development in the US, Turkey and Italy. Baseload Capital is a Swedish-based developer with subsidiaries pursuing opportunities in Iceland, the US, Japan, and Taiwan. Zanskar is positioned as an AI-native geothermal exploration company, using advanced methods to identify more productive resources. They have been backed by Obvious Ventures, USV, LowerCarbon and others, and recently announced good results for greatly expanding the heat resource at a New Mexico plant they acquired last year. There are several other developers out there, which seem to be a bit further behind based on public announcements.

Conclusion

We are still in the early days of next generation geothermal, but the momentum is building rapidly and, crucially, there is tech being deployed in the field. Although deployment is most notably being driven by Fervo, there are multiple companies with multiple approaches. There appears to be a swiftly cohering ecosystem of developers and tech suppliers, as well as a ready potential work force from oil and gas. A lot of progress is going to be made here between now and the end of the decade!

Great post - thanks! You raise a good question on whether emerging firms will be able to compete with learning by doing by incumbents.

I'm not sure it matters in this case. Alternative technologies (hydro, nuclear, gas + CCUS) are lumpy investments with minimal opportunity for learning by doing. In contrast, geothermal's going to need to drill a lot of wells.

Within the geothermal, I think there's potential for technologies to be additive rather than competitive. Does EGS at conventional temperatures have an edge on superhot? Absolutely.

But as novel drilling solutions mature, I can't see why incumbents wouldn't adopt these to hit higher temps. Lots of opportunities for synergies / spillovers across tech.