I’m a bit of an energy and climate nerd, but I’m also definitely a generalist, both by temperament and profession (running a highly diversified climate investment strategy). So I love it when I get to corner people who are deep in the weeds on one particular topic and mercilessly pepper them with questions. Last week myself and Shrav had the privilege of attending the AGM of Junction Growth Partners, our most recent fund investment at Keeling Capital and a manager who is very much deep in the weeds with the European power sector. The event was held just outside Brussels and included - a real treat - a visit to the control room of the Belgian grid operator, Elia. The whole thing was fascinating and I learned a lot, so I wanted to share here.

Key takeaway: the challenges of variable renewable integration are very real and open up huge opportunities for flexibility and grid technology. This isn’t new information but was driven home powerfully hearing it directly from a transmission system operator (TSO).

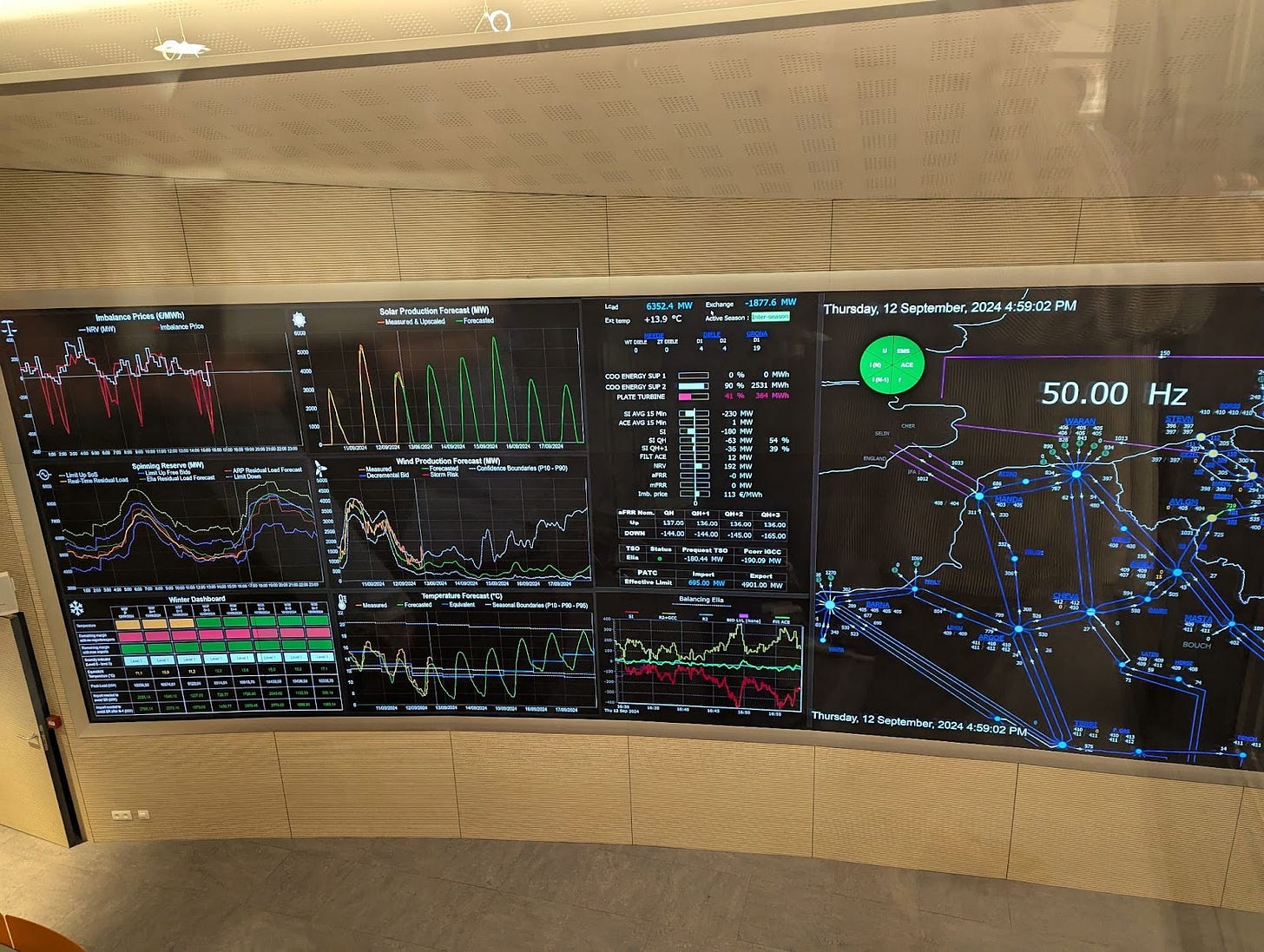

Electricity Maps is one of my favourite websites (and mobile apps), but Elia’s dashboard puts theirs to shame!

What became apparent during the tour was just how many things need to go right to keep the grid functioning. There is a huge amount of coordination that needs to happen both within and between TSOs to keep the lights on. Analytics play a vital role, enabling severe scenarios to be planned for so they don’t have to be dealt with as emergencies in real time.

Belgium is ahead of the curve on technology adoption. It caught my eye reading the recent DoE paper on grid enhancing technologies (covered here) that Belgium was cited as an early adopter of dynamic line rating (DLR). The technology they use is Ampacimon, a Junction portfolio company, who also presented at the AGM. Our guide at Elia said that their technology increases grid capacity by 30% and they are also using it for days ahead forecasting.

Belgium has a surprising amount of solar. The grid has a peak load of around 10GW and has about the same or slightly more of installed solar capacity, which delivers about 8GW to the grid after losses from inverters and various inefficiencies are accounted for. Just last year, Belgium installed a whopping 1.8GW, mostly in Flanders and mostly rooftop solar.

Solar is relatively easy to forecast, but wind is very challenging. It is difficult to make out on the above photo but the middle panel in the second column from the left is the wind power actual and forecast, with the green line being base case forecast and the top line being 90% percentile confidence interval. You can see there is a huge margin of error.

Whilst the Elia control room dashboard has a wealth of information, one metric was notable by its absence - carbon intensity. When I asked our guide about this he mentioned, firstly, decarbonisation isn’t part of the TSO’s mandate. They are responsible for reliability of supply. Secondly, he said that the carbon intensity from the generation mix available on Electricity Maps, for instance, doesn’t capture the whole picture. The carbon intensity of grid depends not only on the carbon intensity of the generation mix but also on the carbon intensity of the grid management. This is becoming more and more challenging with increased penetration of variable renewables and most often involves using natural gas peaker plants (which are less efficient that combined cycle gas plants that are used for baseload) or even, very occasionally, jet engines. This is to such a degree that marginal solar additions in the near term would not incrementally reduce the carbon intensity of electricity because of the impact on grid management.

What is glaringly obvious is that flexibility - be it through demand-side mechanisms like virtual power plants (VPPs) or storage - is an absolutely critical unlock for further decarbonisation of the power sector (and onwards to other sectors being electrified - road transport, heat, etc). This will need to be accompanied by a suite of enabling technologies for the grid, like enhanced visibility and control on the low-voltage distribution system (the focus of Eneida, another Junction port co) or managing congestion with DLR.

Some other things I learnt at Elia:

The interconnectors between the UK and Europe are all direct current. It is helpful that line losses over long distances are lower with DC, but the real reason is that the UK and European grids operate at different frequencies (60hz vs 50hz), so can’t be connected directly with AC.

The UK is also the market in Europe that struggles the most maintaining the frequency since as the large amount of wind has reduced the amount of spinning mass providing inertia to the grid.

80% of issues with the lines are caused by lightning strikes - these are common enough that the grid kit can fix faults automatically.

A large part of Belgium’s electricity exports are actually French nuclear that has been routed through Belgium to the UK and, ironically since they crazily shut down their perfectly good domestic nuclear, Germany.

The planned phase out of Belgium’s nuclear power is going to make it more challenging to manage the grid.

The Netherlands has an unexpected amount of solar, over 20GW installed capacity and the highest per capita in Europe. They have also stopped new grid connections due to major issues with congestion.

We also had the pleasure of hearing from the CEO of Ampacimon, Stephan Heberer:

DLR market notably maturing. Previously needed to find an internal champion at a utility customer to try to push technology adoption up the chain. Now it is coming from the top down, driven by increasing issues with congestion across the grid.

US market maturing, expect about half of sales to come from there going forward, helped by regulations mandating increasing use of DLR.

Ampacimon’s technology involves a sensor that sits on the line and measures vibration and temperature, combined with local third party weather data.

There is a light-touch delivery model that just involves using the weather data without devices on the line. This can deliver increased capacity of up to 10%, given the large amount of uncertainty of the data. That compares to capacity unlock of up to 40% when the on-line devices are used.

Not all grids are (yet) congested - this is the core issue that Ampacimon is addressing, so they are focussed on those markets first.

Lastly, but not leastly, visiting Belgium with a Belgian colleague afforded me the opportunity to go to the best frites place in town, Frites Atelier. Right up there with getting to geek out on the European power system!